Getting on Insurance Panels: How to Navigate the Process

By TherapyNotes, LLC on May 22, 2018

Getting on insurance panels can be difficult.

From lost applications to being on hold for hours, it’s no wonder so many therapists only accept direct pay clients. Even without those challenges, it can take up to 4 months to get paneled. Let us help you get started.

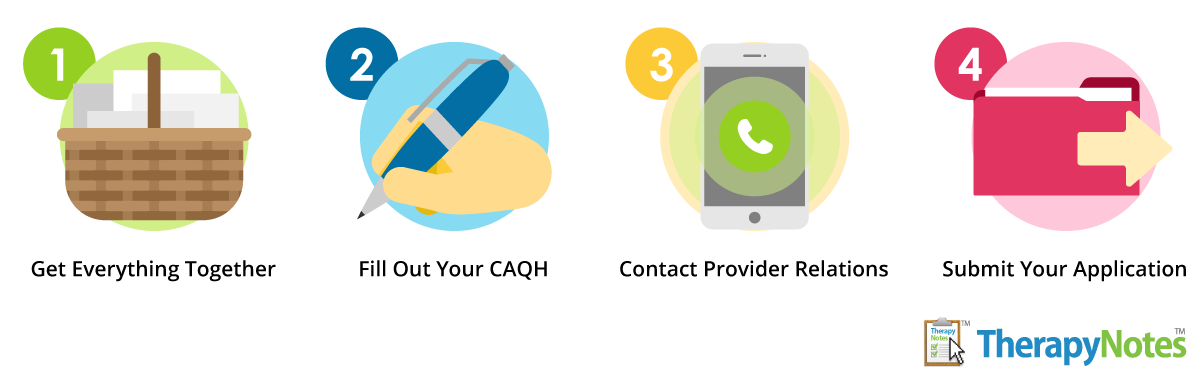

Here’s a step-by-step guide on how to get on insurance panels. (Find out here how we can help you get credentialed!)

Step 1: Get everything together

Getting paneled requires a lot of information and documentation, which may include your:

- Licensure information

- Practice address

- NPI number

- Resume

- Proof of malpractice insurance

- Taxonomy code (if you plan to bill Medicare/Medicaid)

- Proof of liability insurance from your landlord (if you rent)

- Advanced training or credentialing paperwork (if you have any)

Step 2: Fill out your CAQH

Many companies use the Council for Affordable Quality Healthcare (CAQH) for credentialing. But make sure you’re ready before starting the process.

That means your resume needs to be perfect, with dates formatted as MM/YYYY and no gaps in employment. Also, make sure you complete your application through the enrollment hub at CAQH.org and not by paper. The paper application is dozens of pages long, only prints correctly in color, and will need to be entered into the system by clerical staff anyway (if they ever get around to doing so).

After applying, make sure you don’t lose any of your application information, since you’ll be asked to “re-attest” to it 2–4 times per year. Make sure to respond to such requests quickly. Insurance companies will know if you don’t and may refuse to pay claims.

Step 3: Contact provider relations

The next step is to choose which insurance panels you want to be on.

These companies can vary widely in their reimbursement rates, provider-friendliness, and payment speeds and restrictions. Some companies may even require several years of post-licensure experience just to apply. Make sure to ask your network for recommendations and tips.

Once you’re ready, contact each insurance company’s provider relations department for an application.

What to do if they’re full

The best thing you can do when an insurance company tells you they’re full or not accepting applications from people with your specialty is build a relationship with the provider until they have openings for your preferred services. This means calling them to reiterate your differentiating skills.

You could also expand your services and let them know you’ve done so. Some examples may include:

- Evening and weekend availability

- Experience with special populations

- Multilingual fluency

- Handicap-accessible facilities

- Crisis services

- Being located in an under-served area

- Having an in-network referral source

If this doesn’t work, check back quarterly, since their capacity may change.

Step 4: Submit your application

Between filling out your application, making follow-up calls, and getting contracted, the entire application process may take about 10 hours per panel.

After applying, you’ll need to follow up regularly. If your application gets stuck in limbo with no action for too long, it may expire and you’ll have to start all over. To avoid any issues, make sure to call the insurance company every time you submit documentation to make sure they received it. Also, keep copies of everything you submit, since it’s not uncommon for files to get lost, shredded or deleted.

What to do when you’re approved

Before doing a celebratory dance, make sure once you’re approved that you:

- Review your contract closely before signing it, ensuring you thoroughly understand documentation requirements, claim submission and appeals processes, reimbursable CPT codes and diagnoses, fee schedule, required modifier codes, and submission timetables.

- Keep a file with the contract and any addendums available for reference.

- Get to know the provider portal on the insurance company’s website, learning where to find information about claims, client policies, and other useful resources.

- Create a list of phone numbers for the claims department, provider relations, and pre-authorization department, as well as a list of usernames and passwords.

Once you've done this, TherapyNotes™ can help you submit your insurance claims electronically. This will save you time and paper, speed up payments, and reduce the likelihood of errors on claims. You can even submit claims electronically if you're not in-network.

But remember: Insurance companies are there to manage healthcare costs. So, you’ll need to demonstrate why you can help them keep costs low. This will take time and resources, like applying for a job, but it’s well worth it. Good luck!

* The content of this post is intended to serve as general advice and information. It is not to be taken as legal advice and may not account for all rules and regulations in every jurisdiction. For legal advice, please contact an attorney.

Get more content like this, delivered right to your inbox. Subscribe to our newsletter.

More Content You'll Enjoy

The Best Practice Fusion Alternative for Mental Health

Supercharge your Documentation with TherapyFuel!